Regulatory Information

Risk Strategy

and Risk Profile

The Equatex Group provides international deferred compensation plan services for global enterprises, supporting more than 100 blue-chip clients worldwide and reaching out to more than one million of their employees. Equatex has a proven track record of supporting the entire value chain of executive and all-employee compensation plan administration services, including related securities dealer services. Equatex AG, being the headquarters of the Equatex Group, is a FINMA licensed securities dealer. Further, through fully-owned subsidiaries, the group holds securities dealer licenses in the US (via Equatex US Inc.) and the UK (via Equatex UK Limited).

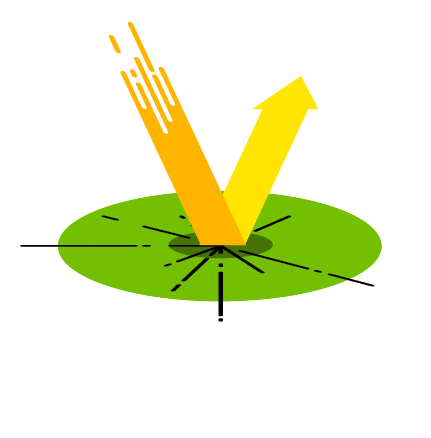

Equatex has developed tools and techniques to adequately monitor risks. We use a five-stage process for managing our enterprise risks, including governance, assessment, measurement, mitigation and remediation. Such process provides for a logical and systematic methodology of identifying, analysing, monitoring, communicating and reporting risks. It further allows Equatex to adjust to risks, as well as pursue opportunities, as they arise. Our risk management process fulfils the stringent requirements for FINMA, FINRA and FCA licensed securities dealers, and is being reviewed by internal and external auditors on an ongoing basis. It incorporates elements from the ‘ISO 31000 – Risk Management’, and the ‘Enterprise Risk Management – Integrated Framework’, as issued by the Committee of Sponsoring Organisations of the Treadway Commission (COSO).

Given our narrow and strictly passive execution only business model, which is by design governed by the plan rules of our Corporate Clients, our regulatory risk exposure as a securities dealer is deemed “low to moderate”. Naturally, there are certain operational risks involved in operating an IT-Platform, which have been categorized according to the Basel II taxonomy and subsequently flow through the FINMA required risk reporting. However, given the top-tier quality of our platforms and systems, as well the well-established Risk & Compliance, Finance and Operations framework surrounding the corresponding monitoring and execution processes, these operational risks are deemed “low to moderate” as well. Besides that, given our contractual parties, our narrow product and service offering, and the fact that the services provided by default involve tax declared assets only, our risk exposure to Money Laundering and Terrorism Financing is deemed “low”.

To ensure ongoing adherence to the risk strategy and risk profile outlined above, regular comprehensive risk assessments are carried out by the Risk & Compliance Department.